As the banking sector continues to evolve, it's essential for industry professionals to stay up to date on the latest industry trends in order to be able to navigate these changes effectively. In this article, we explore 5 key trends that are set to change the digital banking landscape in 2023, such as the increasing importance of conversational banking, which will play a major role in shaping the future of financial services.

These trends will provide valuable insights for banking professionals who want to not just stay informed, but stay ahead of the curve, throughout the digital transformation of the banking industry.

Why is the digital banking transformation so important now?

Digital banking is more prevalent than ever in today’s financial climate. With the growing demand for digital services, the way consumers expect to interact with their financial institutions is changing. In fact, as much as 78% of consumers would rather prefer to use digital banking services than go to a physical branch.

This explains the 70% of customers who have increased their mobile banking usage since 2020, according to Accenture’s The State of Digital Banking: Consumer Survey. Online transactions have also seen significant growth in recent years, with the volume of digital payments expected to reach over 726 billion by 2023.

Banks must adapt and embrace this digital transformation in order to remain relevant in today's digital landscape, or they could risk losing custom to competitors with more agile, customer-centric digital offerings.

What are the trends shaping the digital banking transformation?

1. The cost of living crisis will cause banks to revamp their digital offering

It’s no secret that the recent and ongoing energy crisis has inflation levels rising and customers facing sky-high costs of living. In these tough economic conditions, there is a real urgency for banks to digitize their channels to deliver new, flexible, and affordable services.

A focus on digital tools can help customers navigate some of the financial pressures that they are facing in today’s climate. For example, it can make financial services more accessible for customers who are struggling financially, and also give them greater control over their finances with real-time access to their account and transaction data.

It’s likely that we will see more banks ditching their outdated personal financial management (PFM) solutions and opting for new tools which are based on intrinsic human behavior and promote financial wellbeing. Banks are recognizing that their PFM tools aren’t adding value—they require too much effort from the customer, overwhelm them with too much data, and don’t provide the high-level insights needed to make better decisions.

By investing in new technologies and innovative digital offerings, these banks will be better positioned to meet their customers’ evolving needs. In 2023, being able to anticipate and adapt to these needs is what will differentiate forward-thinking banks from their outdated competitors.

2. Open banking will put more pressure on banks to be competitive

In 2023, open banking and the use of APIs is expected to grow exponentially. Regulatory and technological advancements have made it easier for customers to securely share their financial data with external providers.

What’s more, a recent McKinsey study found that over 60% of consumers would be willing to share this data with third-party providers in order to access better financial products and services. This demand puts pressure on traditional banks to improve their offerings if they want to remain competitive in today’s financial market.

Open banking also makes it easier to compare rates and switch between different providers, which means that banks will need to focus not just on providing a seamless customer experience, but also on using customer data to offer financial products which are personalized to their customers.

So as well as leveraging new technologies, banks will also need to build strong partnerships with fintech companies and other third-party providers, to ensure that they are able to offer the most competitive range of services.

3. More people will be willing to bank on their own

Every year, consumers become increasingly tech-savvy, and in turn, their expectations are increasing too. Consumers want to be able to manage their finances quickly and easily, without having to wait for assistance from their bank’s customer support team. This is driving a demand for self-service banking solutions that are accessible, user-friendly, and available 24/7.

Being able to access their account information and perform transactions at any time, from any location, gives customers greater control over their finances. This creates a more positive banking experience and therefore, increased customer satisfaction. According to a recent Accenture study, over 80% of consumers use digital banking services, and self-service options were found to be the most popular.

Furthermore, self-service solutions aren’t just more convenient for customers, but for banks too. Since customers can perform tasks on their own, this reduces the demand for customer support staff, therefore reducing operational costs too.

4. Fintechs will move from disrupters to enablers

Fintechs have disrupted the financial services industry in recent years by offering innovative solutions that challenge the traditional ways of banking. However, thanks to the regulatory changes in third-party policies that have come into place recently, the opportunities for partnerships between banks and fintechs have expanded.

In 2023, the number of banks collaborating with fintech companies is expected to rise substantially, driving the transition from being disrupters, to enablers, within the financial services industry.

This transition will allow fintechs to leverage the established customer base, regulatory compliance, and infrastructure of traditional banks, whilst simultaneously bringing progressive solutions and customer-focused approach to the table. This epitomizes what is meant by the ‘future of banking’.

On the future of banking, author, entrepreneur and expert in AI and Fintech @Brett King comments: “By 2030, I would say that we will probably have 2 billion people that will be using day to day banking services, independent of banks.”

Not only are fintechs building a reputation for reliability and stability in the industry, but they also have the ability to expand into new markets and offer their services to a wider customer base than traditional banks. For example, reaching underserved populations who may have previously been excluded from financial services due to geography, financial status, or other barriers.

5. Conversational banking will become even more mainstream

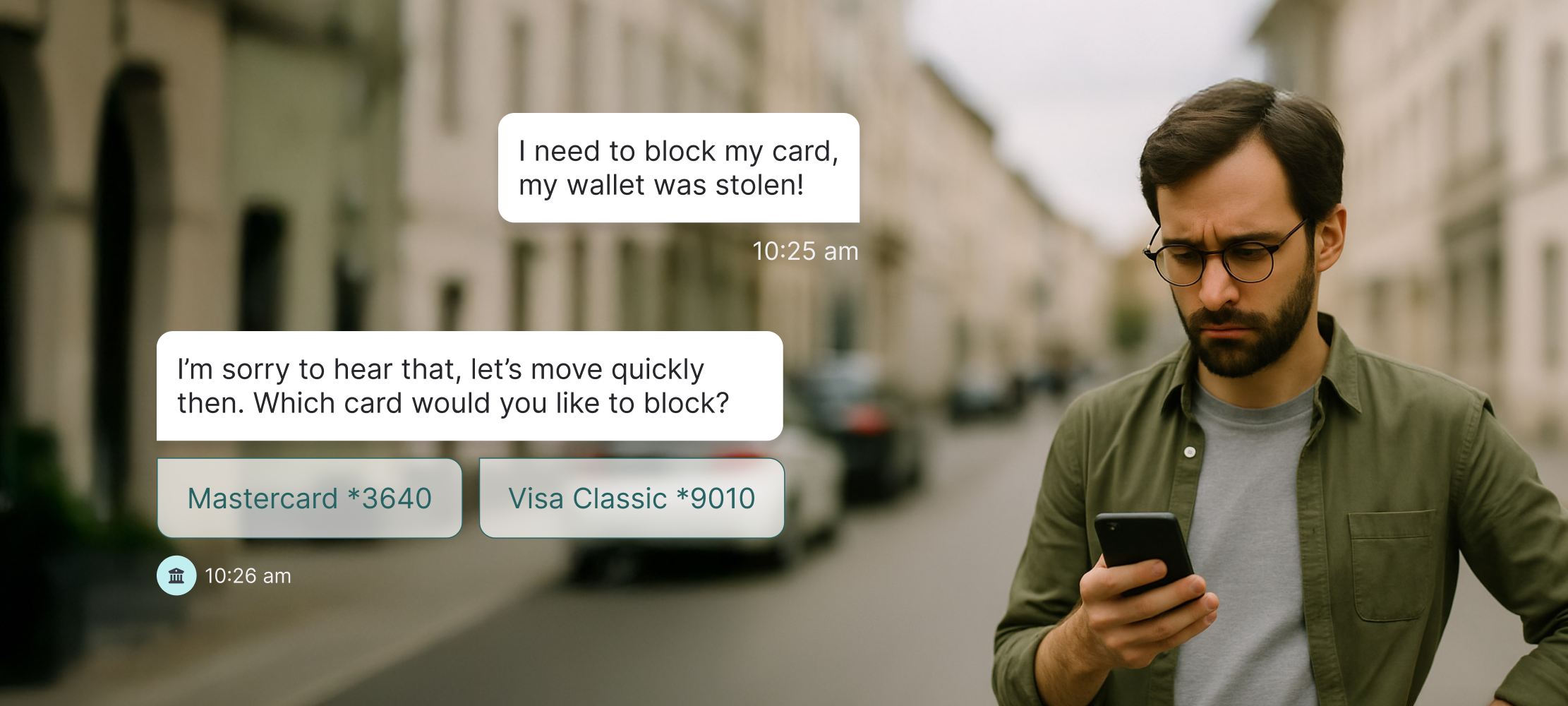

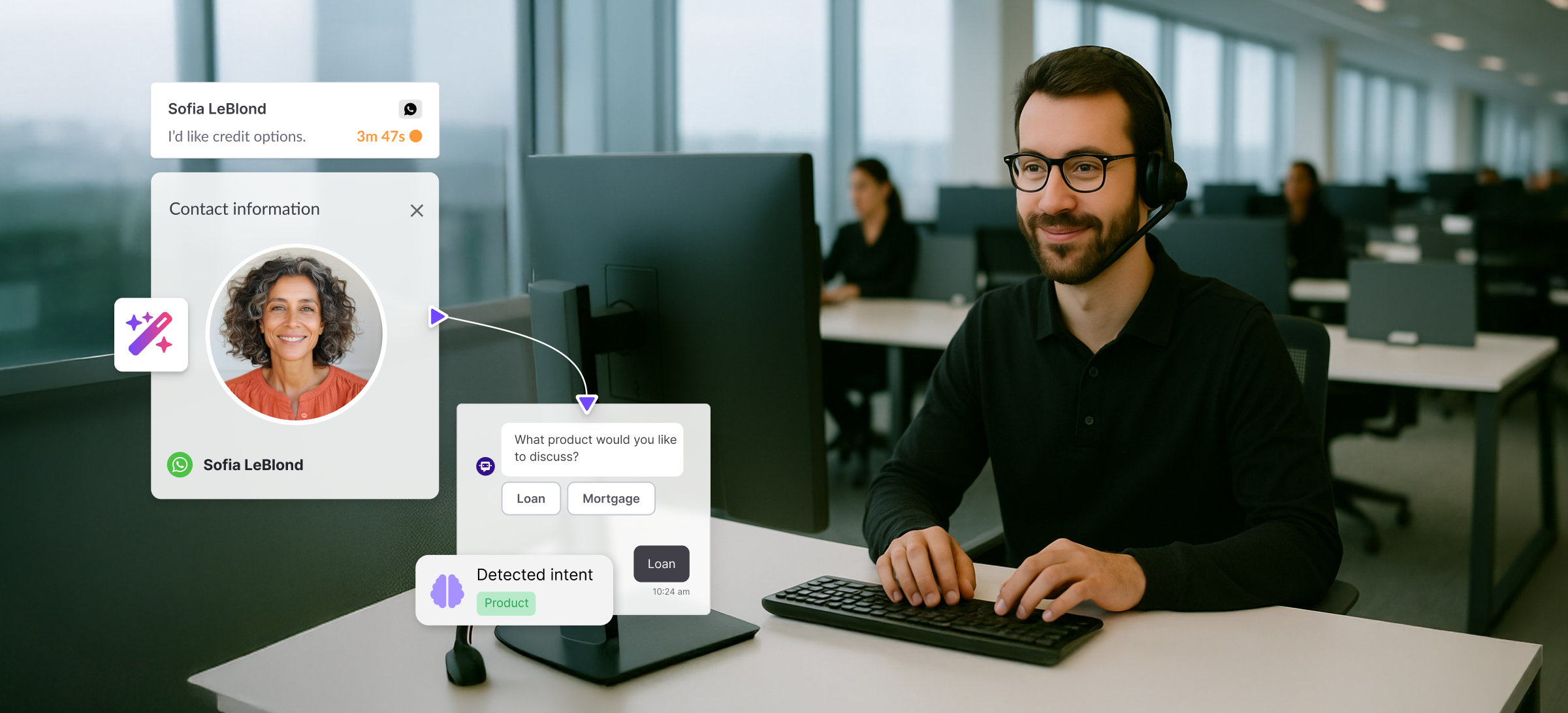

Conversational AI has made it mainstream recently, thanks to AI-powered chatbots and language models such as ChatGPT. Nowadays, consumers are becoming increasingly comfortable with using messaging apps and virtual assistants to communicate with businesses and perform transactions. This is why conversational banking will play such a major role in the future of financial services.

Recent Forrester studies show that 87% of banks are aware that the traditional banking experience is not enough to meet customer expectations nowadays. This explains why 75% of financial institutions have already considered leveraging conversation AI, data, and analytics to improve their CX, and research by Juniper predicts that by the end of 2023 90% of interactions in banks will be automated.

As the use of NLP (natural language processing) technology becomes more widespread, it allows for more natural and intuitive conversational customer experiences. By using customer data and conversational interfaces to recommend savings or loan products that are tailored to a customer's individual financial needs, banks will also be able to offer more personalized services which can improve the efficiency and speed of transactions.

Moreover, according to studies by Salesforce, 64% of CS advisors who assign part of their workload to chatbots, say that it allows them to spend more time solving complex problems, therefore saving time and money. In fact, with chatbots, banks can save up to 4 minutes, or $0.50-0.70 per enquiry, which equates to a reduction of 30% in customer support costs.

Conversational banking has opened up a world of opportunities in the financial services sector, and will continue to do so in 2023 as recent studies show that more than 60% of U.S. consumers’ preferred communication channel is a digital self-service tool such as a chatbot or conversational app.

By enabling banks to automate routine tasks and provide quicker, more accurate responses to customer inquiries, conversational banking makes it easier and more frictionless than ever for customers to interact with their bank.

Banking opportunities in 2023

The digital banking transformation is being driven by a number of key trends, with conversational banking at the forefront. By leveraging conversational banking technology, banks can offer a more convenient, accessible, and personalized experience to customers.

At Hubtype, we make it easy for banks to integrate conversational banking into their digital channels. Book a demo with Hubtype today to learn more about how your bank can benefit from this opportunity.

.jpeg)

.jpg)