This year, for the first time ever, Gen Z is made up of a higher percentage of adults than it is teenagers. Gen Zers born between 1996 - 2005 are already 18 or older, and are able to manage their own finances. Even the youngest of the generation born between 2005 - 2010 are old enough to do so with the help from their parents or guardians.

So what does that mean for banks?

Digitally-native consumers

If there’s one thing that banks need to keep in mind about Gen Z, it’s that they are a digitally-native generation. This means that they grew up with technology and in turn, tend to rely on it in both the personal and professional aspects of their lives, which includes managing their finances.

For Gen Z, technology is like second nature in a way which can’t be said for older generations. This means that their expectations for speed and ease of use when it comes to tech are even higher.

As a generation, Gen Z also tends to be multi-taskers, which explains their preference for carrying out as many tasks as possible through one chosen device - their mobile phone. In fact, for 73% of Gen Z, mobile is their primary engagement channel.

Whilst some traditional banks rely on mobile banking apps in an attempt to keep up with the “always-on” generation, simply creating an app isn’t enough to keep Gen Z satisfied. Not only must their apps be modern and simple to navigate, but they should also be hyper-personalized. Luckily, conversational apps help bridge the gap between customer expectations and reality.

Why is targeting Gen Z important now?

In addition to their own earnings, Generation Z is set to inherit over $68 Trillion from older generations And although some of their finances might be inherited, their banking habits and preferences are not—what Gen Z wants and expects from a bank is not the same as their parents.

This was confirmed by recent market research carried out on 1,000 US banking customers, which showed the differences between the way Gen Z bank compared to other generations, specifically when it comes to a demand for digital.

To meet those demands, banks need to rethink their strategy if they want to keep Gen Z satisfied. For example, not only do over 80% of Gen Zers already use a money Transfer app, but they are also the generation which use the most diverse range of social platforms to build their financial literacy, such as using ‘Fintok’ to follow, engage with and learn from ‘Finfluencers’.

Fintok and finfluencers

The financial side of TikTok, also known as FinTok, is on the rise. The type of videos in this space can cover anything from savings, to investments, to taxes, to debt, and are being viewed primarily by younger viewers who are from generation Z.

With the hashtag #stocktok reaching 1.4 billion views, and #PersonalFinance with as many as 4.4 billion, it is clear to see that this is a growing trend, which could very possibly become the modern generation’s main source of financial information and advice.

What Gen Z want from their banking experiences

Before investing in a new product or service, Gen Z does what they do best: they Google it. And that goes for more than just the latest fashion or technology, but also for financial research and recommendations too. Which explains why, according to the US Banking Digital Trust Benchmark 2022, they are the most likely to consider non-traditional providers such as Apple, which older generations may not.

So once they’ve done their research, what is a typical Gen Z customer looking for from a bank? Well, they’re known as the ‘always-on’ generation for a reason. As with the other services they use, Gen Z expects 24/7 self-service as standard, and banking is no exception to the rule. Waiting in queues whether in person or online, is a thing of the past for Generation Z customers, they want to be able to communicate with their bank any time, anywhere.

But keeping Gen Z customers happy is more than just round-the-clock service. To build true brand loyalty, banks need to solve the personalization-privacy-ethics issue. This means getting the right balance between offering customers experiences that are personalized to their needs and habits, whilst still prioritizing the privacy of their data. Ethical brand values like this are something that Gen Z takes seriously, and could make the difference between which bank they choose to give their business to.

Conversational banking

Another note-worthy point about Gen Z, is their preference to be served via messaging channels. Online, self-serve, text-based chat had the highest appeal with Gen Z out of all age groups surveyed, with 53% preferred messaging their bank over having to email or phone them.

In regard to this digitally-native generation, head of financial services for North America at Infosys, Dennis Gada, comments that: "For Gen Z, banking or financial services is an extension of their lifestyle... the more digital a bank is, the higher their level of trust."

This explains why Gen Z are 13% more likely to be unsatisfied as a result of bad digital customer experience than Gen X (baby boomers), due to their higher expectations.

In fact, 35% of Gen Z said that one of the most important factors they consider when choosing a bank is the digital experience. Which highlights just how important it is for banks to prioritize frictionless experiences for their customers.

Making this possible with conversational apps

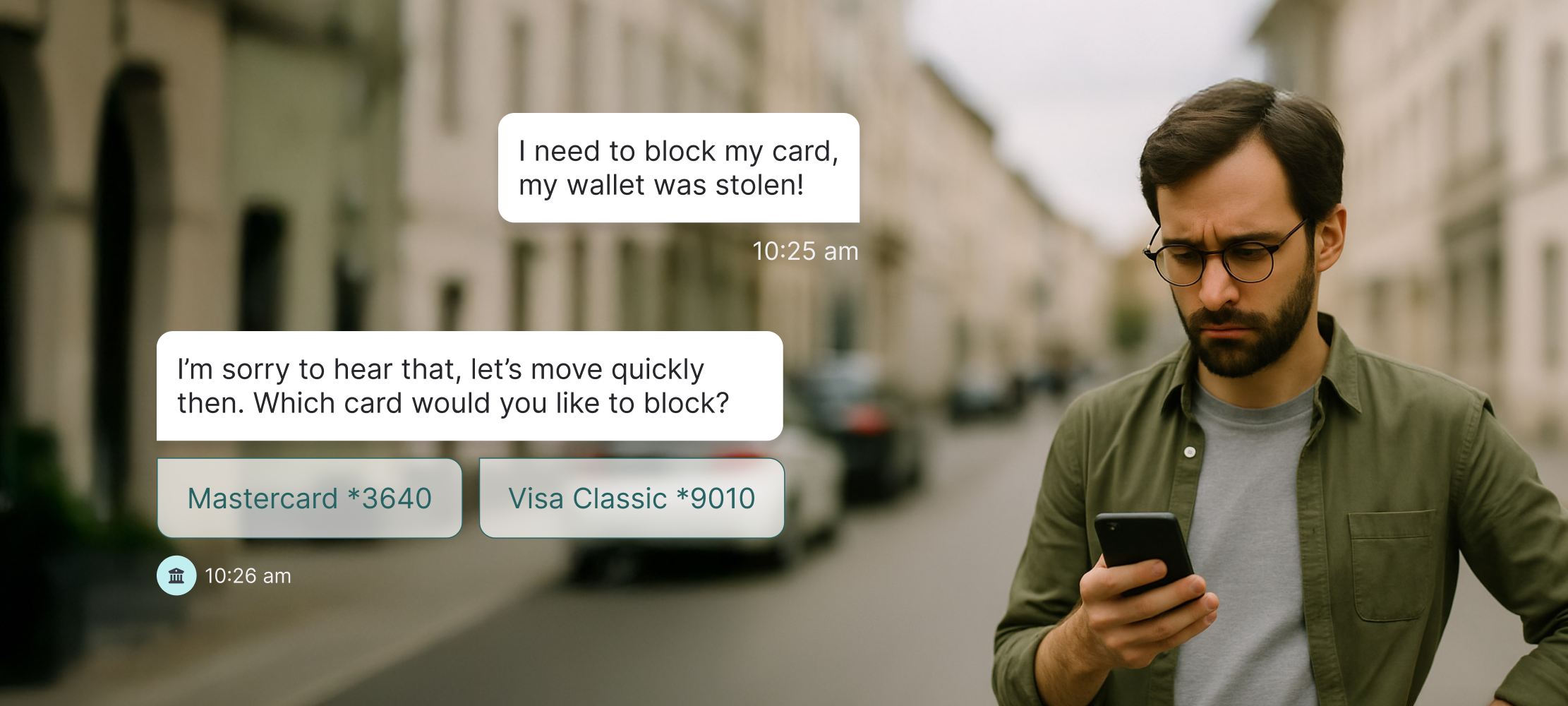

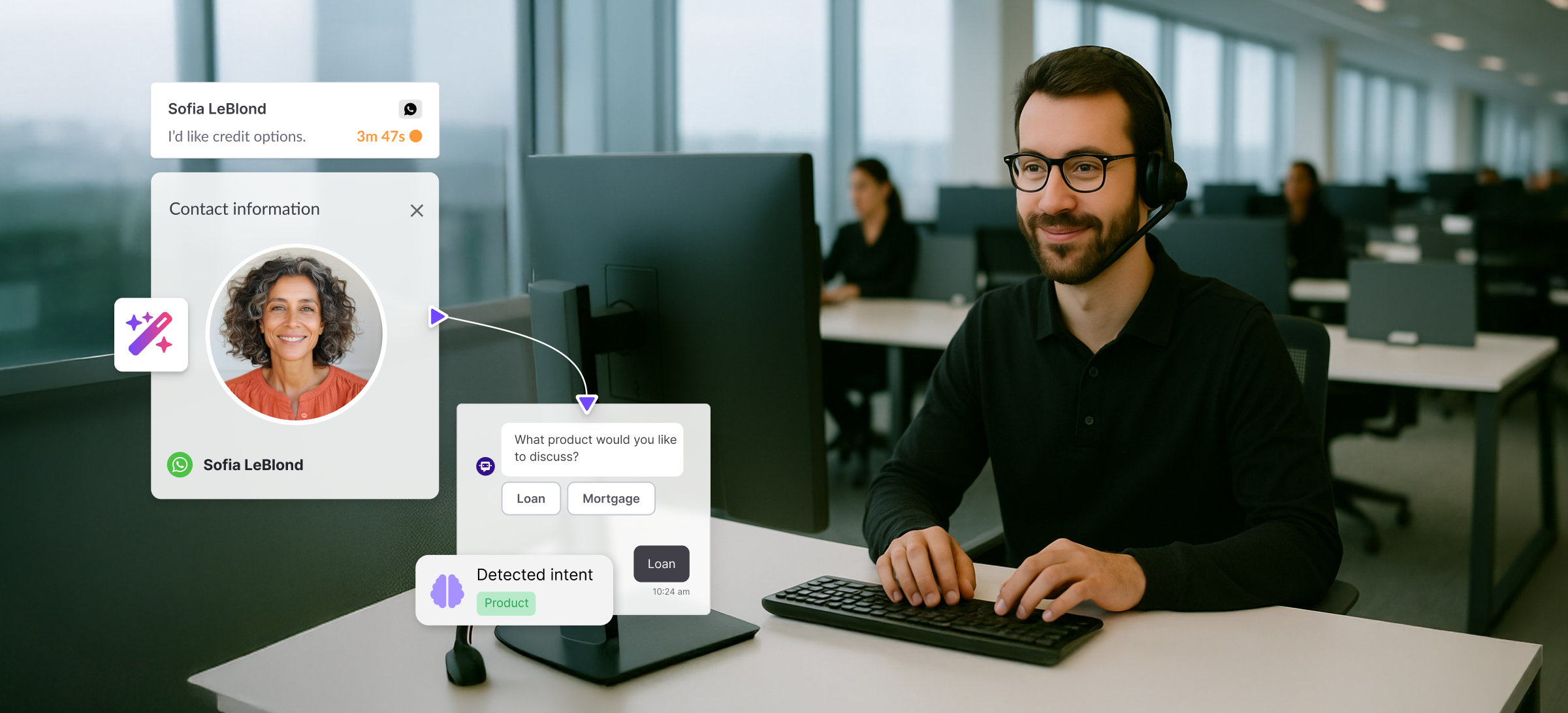

A major factor in how the financial industry can make these improvements to their customer experiences is through the use of Artificial Intelligence. Since Generation Z has grown up with mobile messaging as their primary form of communication, in order to appeal to them, it’s vital for banks to invest in technology such as conversational chatbots which can seamlessly integrate onto a mobile platform.

A chatbot or conversational app can enable banks to provide 24/7 self-service, or handover to human agents when needed. Not only is messaging the primary channel through which Gen Z wants to communicate with their bank, but 39% of those surveyed also said that they would be interested in automated financial guidance.

Start gaining Gen Z’s banking business

Now we know how differently Gen Z banks compared to older generations, it’s clear that meeting their expectations for fast, convenient, digital experiences is the future of banking. If banks aren’t able to keep up, they will risk losing the business of this younger generation to new innovators who can better meet their needs.

To discover how your bank can start automating CS, personalizing experiences, and unifying channels in order to win Gen Z customers, book a demo with one of Hubtype’s conversational experts today.

.jpg)