Fintechs are disruptive by nature. They see customer pain points as opportunities to reimagine banking experiences. And, almost all of the major players rely on fintech chatbots to realize this goal.

For some, the idea that chatbots power the seamless experiences that define fintechs is hard to imagine. A text-only experience with a bot could only make things worse, right?

Right! But these days, chatbots are so much more than that. To understand how powerful fintech chatbots are, we first have to know where chatbot technology stands today.

What is a fintech chatbot?

Finance chatbots hold conversations via text or buttons, in lieu of providing direct contact with a live human agent. They are available 365 days a year and can answer questions 24/7, quickly solving common issues.

Resetting a password, managing transactions, or even opening up a line of credit is simple and seamless. What’s more, fintech chatbots can handle multiple requests at a time, which makes them a hard-working part of any financial institution.

Why do fintech chatbots matter now?

Financial services are going through a rapid digital evolution to keep up with the needs of digital-native consumers. The percentage of Americans who use fintech services rose from 37% in 2020 to 48% in 2021, and 65% in 2022.

With a 3,150% growth rate in terms of successful chatbot interactions between 2019-2023, and an estimated 862 million hours saved for businesses in the near future, it’s clear that chatbots will transform how business communication is done in the future.

What makes today's fintech chatbots different?

When we talk about chatbots, the problem is that many people still define them by their early failures. They immediately think of the text-only, frustrating experiences chatbots once provided.

But chatbots have evolved way beyond their disappointing predecessors. They've grown so much that we now call them conversational apps or conversational interfaces.

Fintech chatbots are visually engaging

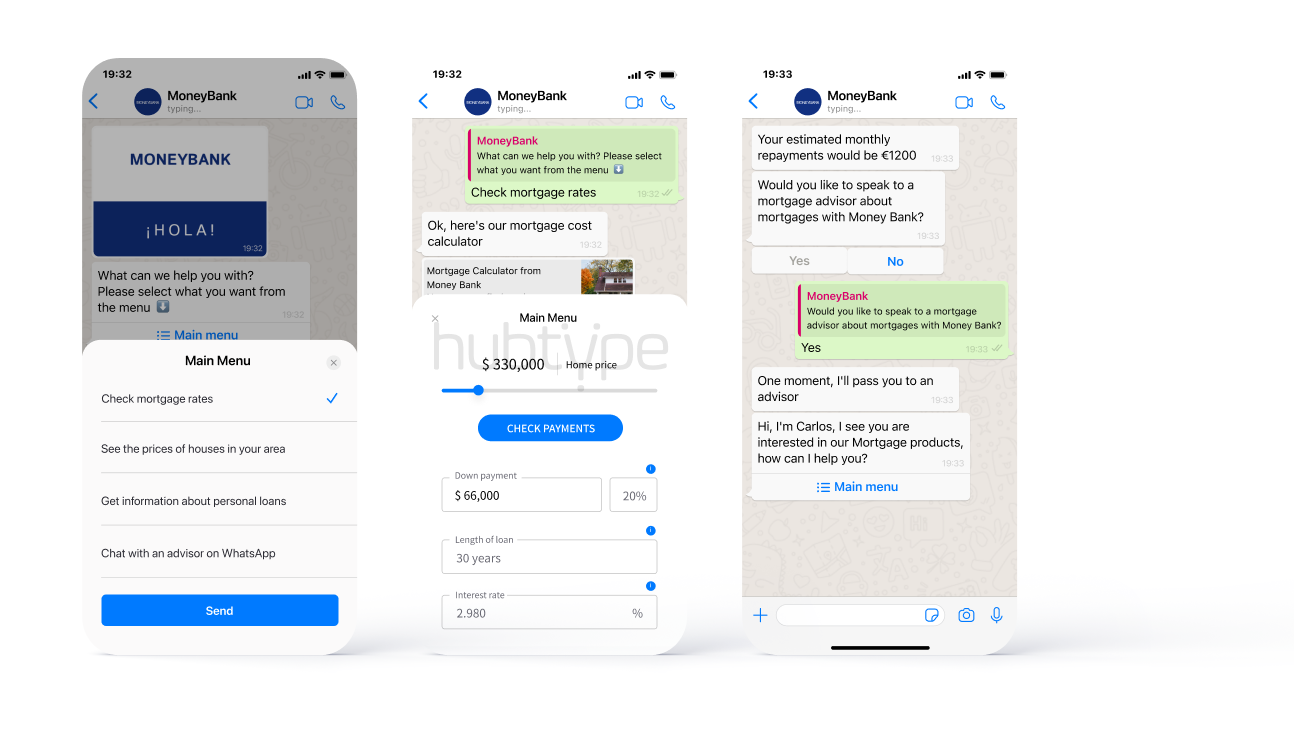

Conversational apps are a combination of graphic elements, text-based messaging, and rich experiences. Rather than rely solely on text exchanges, conversational apps use buttons, images, embedded calendars, and much more to make things easier.

Here's an example for all of our visual learners:

This intuitive user interface reduces time to resolution. Conversational apps reduce the time it takes for a customer to complete a goal by 40% and increase the number of goals completed by 25%.

Fintech chatbots simplify complex topics and workflows

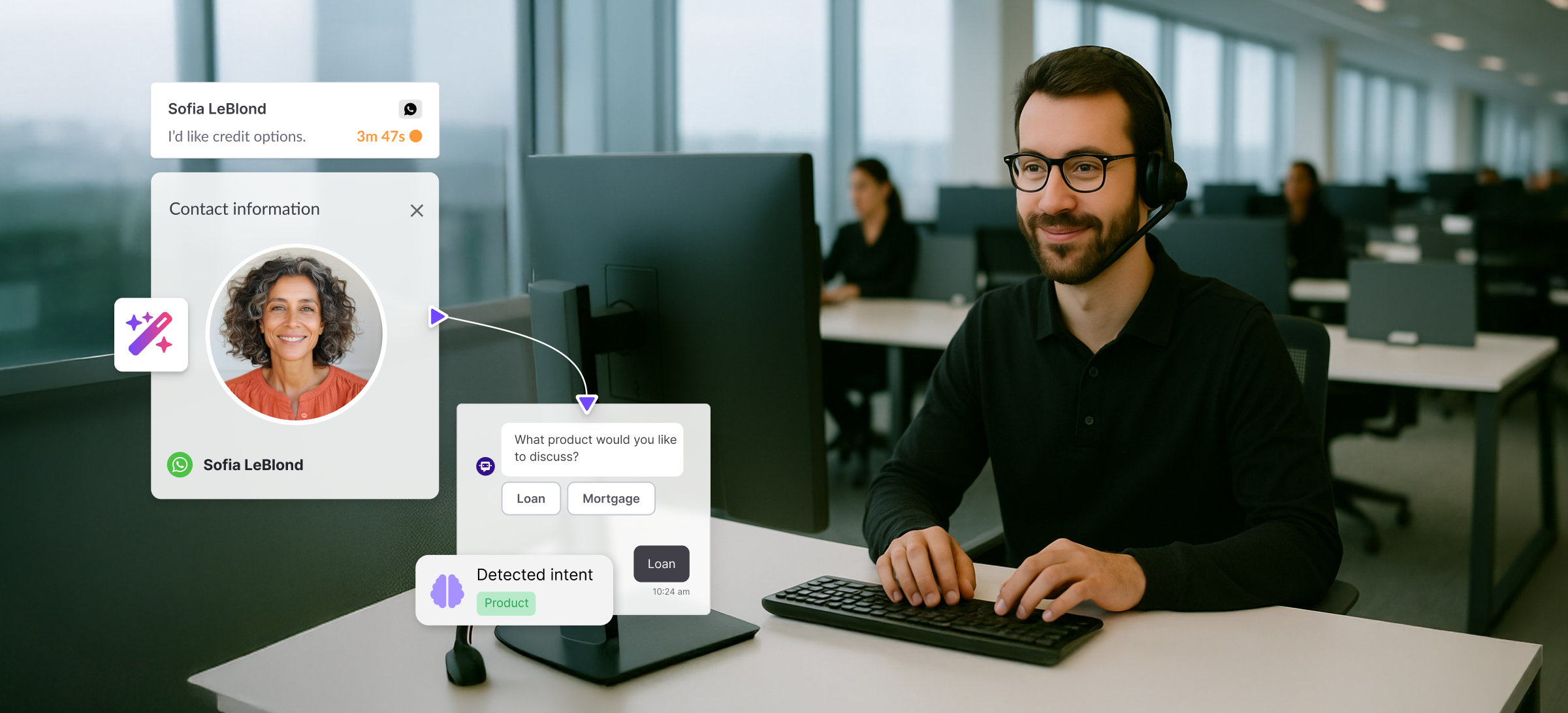

Successful fintech companies do not view chatbots as a cost-saving strategy or a tool to replace human agents. While chatbots do improve metrics like cost-per-contact, this is not the primary focus.

Instead, successful fintechs view chatbots as a tool to increase customer satisfaction and loyalty. They carefully map out the customer journey and use automation only where it increases customer satisfaction.

For any particular use case, a chatbot must match or exceed the experience that the human support team can provide. For fintechs, the decision to use a chatbot involves a careful assessment of the customer journey. They pinpoint sources of friction and evaluate current resources.

Fintechs are successfully automating processes that, until now, were too complex to be handled by a bot. They are designing experiences that eliminate paperwork, hold times, and friction in their customer service models.

Fintech chatbots and humans work better together

Another common misconception is that fintech chatbots are designed to replace humans. That is far from the truth.

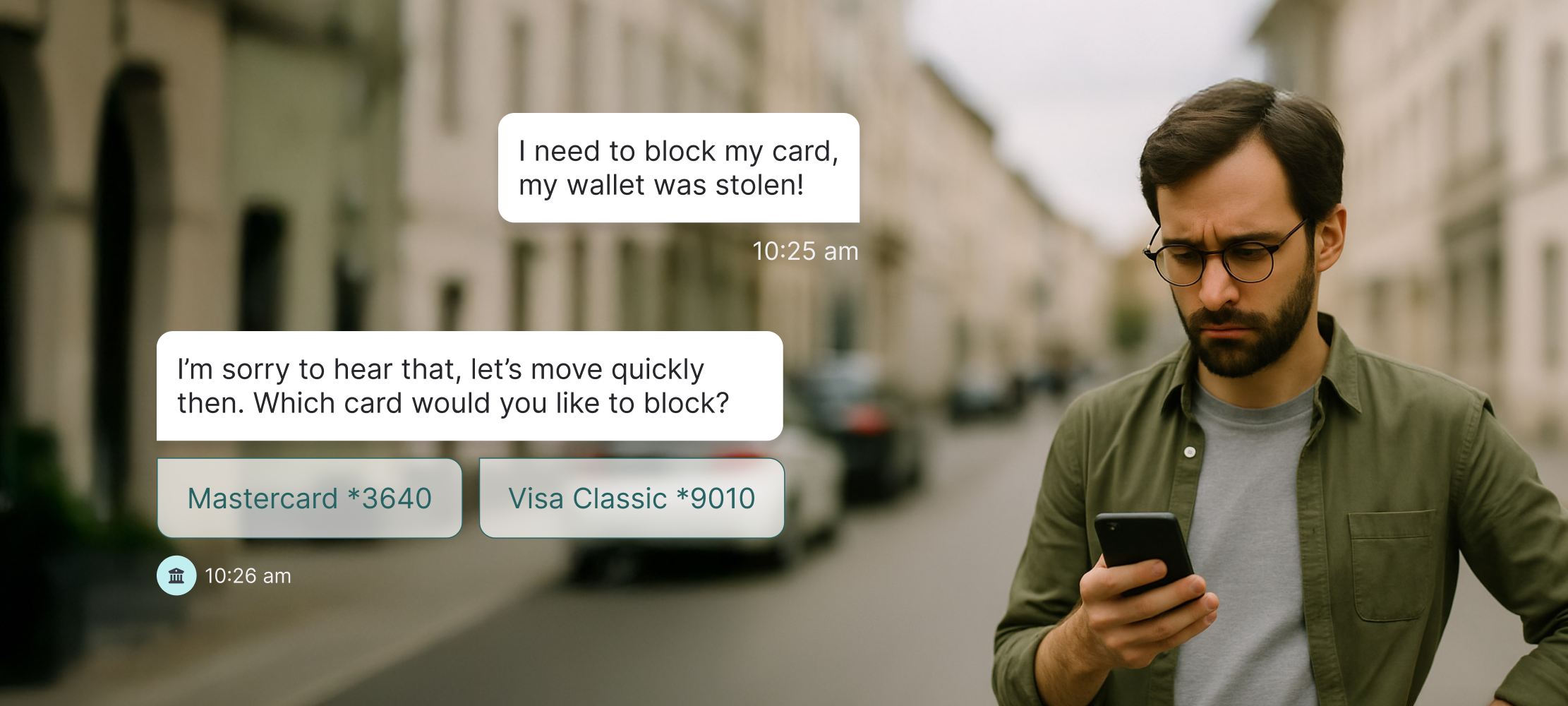

Well-designed fintech chatbots hand conversations over to a human when necessary. Getting the chatbot human handoff right is critical to ensuring customer satisfaction.

Again, fintechs are all about customer-centricity and control. If customers have an issue that needs to be escalated, they need to be able to speak to a human agent.

This balance between chatbots and human resources is key in improving customer retention and reducing churn.

Examples of fintech chatbots in action

Here are a few examples of enterprises using fintech chatbots to redefining financial service models.

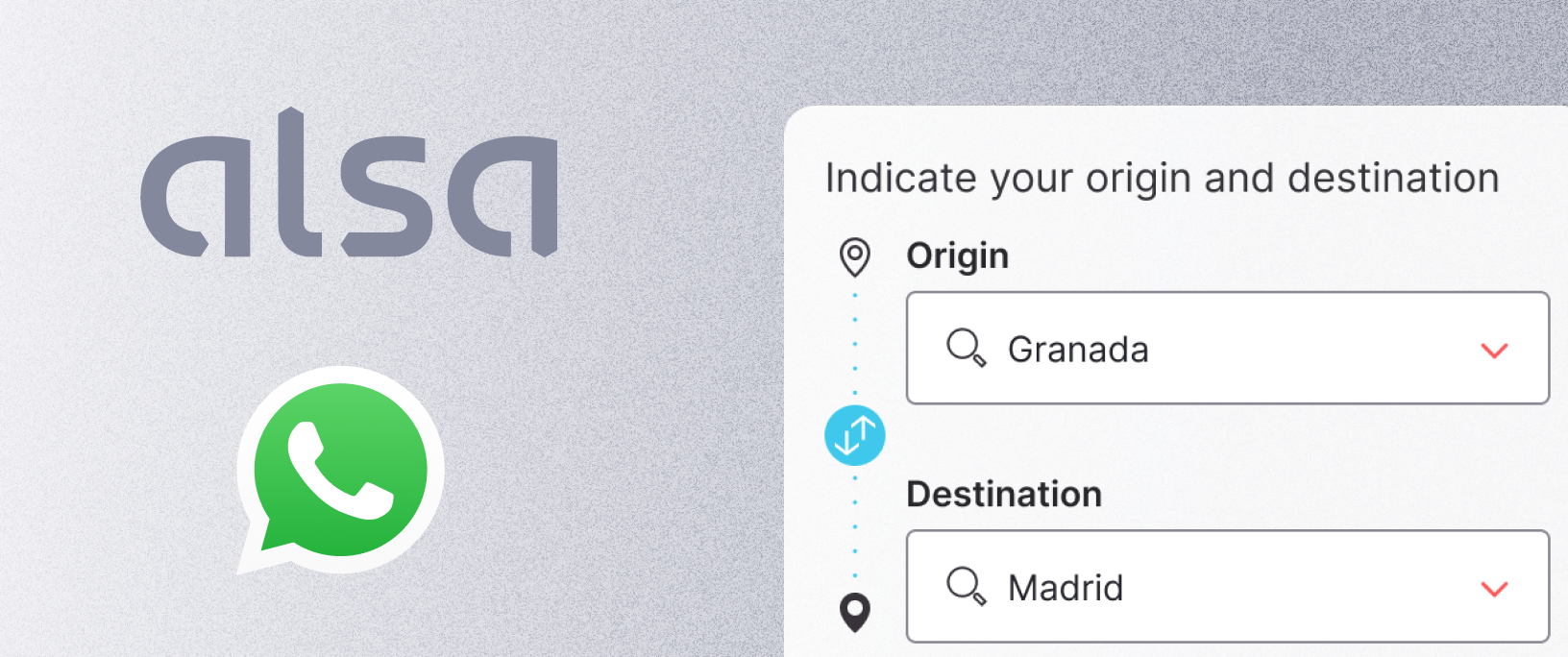

- Bankia uses WhatsApp and other messaging channels to offer seamless, personalized service

- N26 helps customers open a bank account in just 8 minutes

- Ant Financial's 3-1-0 lending enables borrowers to complete their online loan applications in 3 minutes, obtain approval in 1 second with 0 human involvement.

- Kabbage Inc. provides fully automated funding to small businesses in just 7 minutes

These experiences are made possible through fintech chatbots. Service provided by a fintech chatbot is immediate, contextual, and well-designed for each use case.

Use cases for fintech chatbots

When we talk about use cases for fintech chatbots, customer support is always at the top of the list. With conversational banking, customer support isn't reserved for when a customer has an issue.

Instead, clients are seamlessly guided through all of their transactions. Fintech chatbots help banking customers:

- Choose the most suitable mortgage loans

- Understand investment risk

- Simplify bank applications

- Get financial advice

- Prevent fraud

- Perform core banking activities like payments, transfers, and deposits

The use cases for chatbots are endless. And, the pandemic is accelerating the need for conversational banking. The question is: what is the biggest pain point for your customers? Where there is friction, there is an opportunity.

What's next for fintech chatbots?

Fintechs have reshaped customer expectations, setting new and higher bars for user experience. Any financial service provider that has not developed a conversational strategy is already behind.

“Banks shouldn’t be looking at fintechs as competitors but as enablers and partners on the path to innovation. Forward-thinking financial institutions should invest not only in transformative partners but also in transformative compliance. Rethink risk methodologies and traditionally risk-conservative practices. Niche brands can help a financial institution differentiate, capitalize on existing markets and meet new ones.” - Michelle Prohaska, NYMBUS

That's where we come in. At Hubtype, we work with the world's leading banks to create seamless banking experiences. Our conversational platform is trusted by Bankia, Caixa Bank, Deloitte, and other leaders in the financial services industry.

Learn more about how financial institutions use Hubtype here, or read about different type of chatbots here.

.jpg)