Digitally-native consumers are forcing financial institutions to rethink the experiences they offer. These customers expect a new level of convenience, innovation, and trust. If traditional banks want to thrive, they need to adapt quickly.

But what makes a banking experience great? To answer that question, we’ve rounded up insights from the top thought leaders in the financial services industry on what makes a best-in-class banking experience and what actions they take to meet rising expectations.

1. Convenience via digital channels

The number of customers who want to engage with banks digitally has increased tremendously over the past two years. In the past, digital customer interaction benefits in banking were thought to be limited to cost savings and increased operational efficiency. Today, it’s clear that digital engagement is, most importantly, a tool to improve customer experiences and satisfaction scores.

Reveka Katakis, Head of Digital Engagement at National Australia Bank, explained how NAB is evolving to meet the needs of modern customers. “The digital acceleration we have seen since the beginning of Covid has been phenomenal,” Katakis told CMO. “We saw a shift in the way Australians want to bank with us. For example, use of mobile banking apps went from 35% in March to 59% by September 2020.”

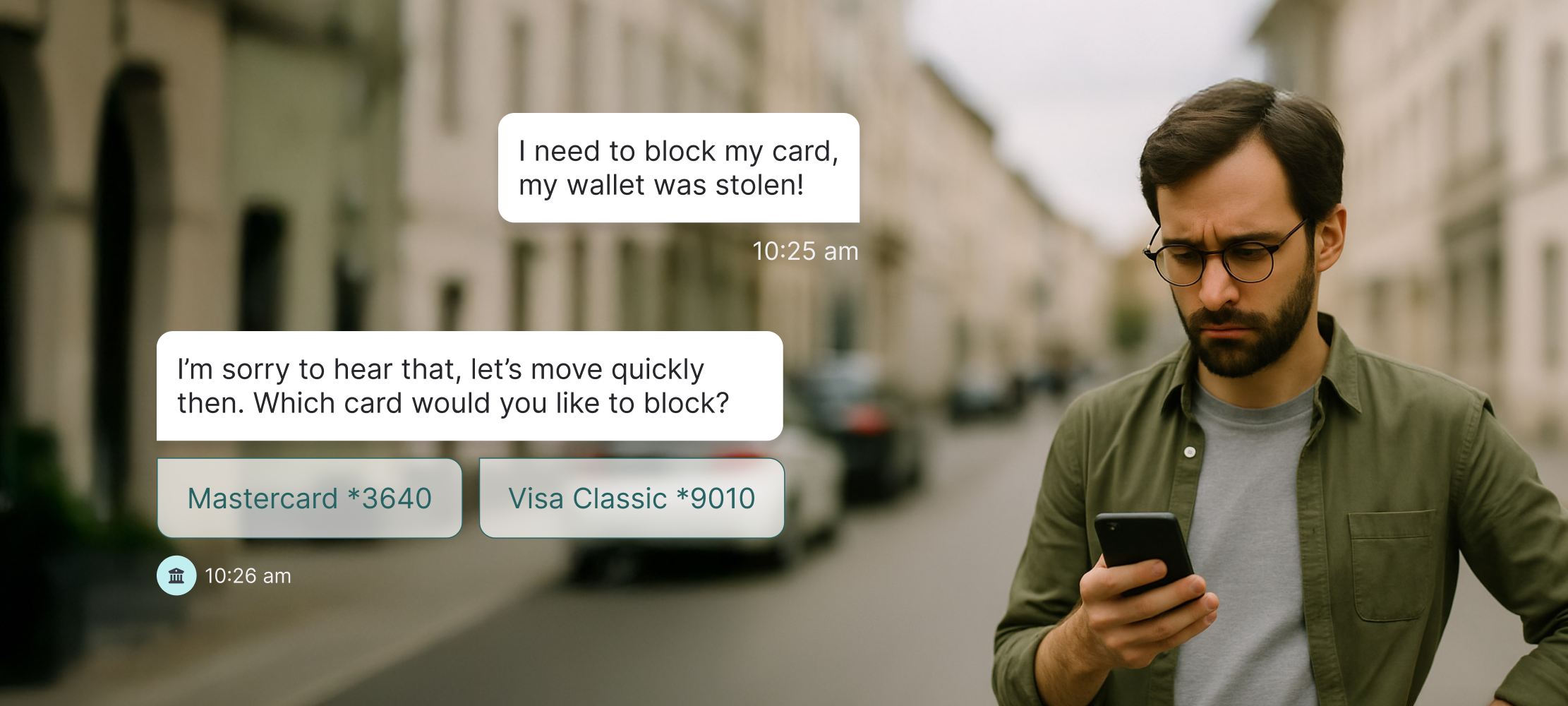

To meet these needs, NAB accelerated its adoption of asynchronous messaging-based customer service and automation. This included rolling out Apple Business Chat (iMessage) and WhatsApp.

“WhatsApp was another easy choice... We put automation in for some simple and quick FAQs in a bot, and you could choose to interact with the bot or connect with the banker,” explained Katakis.

According to the metrics, the approach is paying off. Customer satisfaction scores are now above 80% and 90,000 calls have been deflected to digital channels.

2. Intuitive interfaces

As customers rely more on digital channels, the interfaces of these platforms are becoming more critical. Customers have become accustomed to instant access and seamless experiences, and they are more critical of clunky user interfaces.

Intuitive and conversational interfaces are crucial for meeting clients’ expectations. This past year’s Bank Customer Experience (BCX) Awards reinforced this point. The BCX Awards, presented by Networld Media Group, honour financial institutions and technology providers whose branches and technologies are having the greatest impact on consumers around the world.

In the most recent edition, First National Bank was one of only four winners, taking home the prize for its mobile experience. The experience includes personalised shopping features, product recommendations, interactive video content, and the ability to apply for loans, deposit accounts, and other online services.

"Receiving this latest recognition for our world-class mobile platform affirms that our significant investments in technology have resulted in a customer experience that sets FNB apart," said Samuel D. Kirsch, Chief Digital Officer of First National Bank.

"FNB's Solutions Center e-Store gives clients the ability to filter and compare accounts, utilise tools to find products that best match their needs, and make purchases via a shopping cart. We provide a simplified experience unique to banking but similar to other online retail experiences."

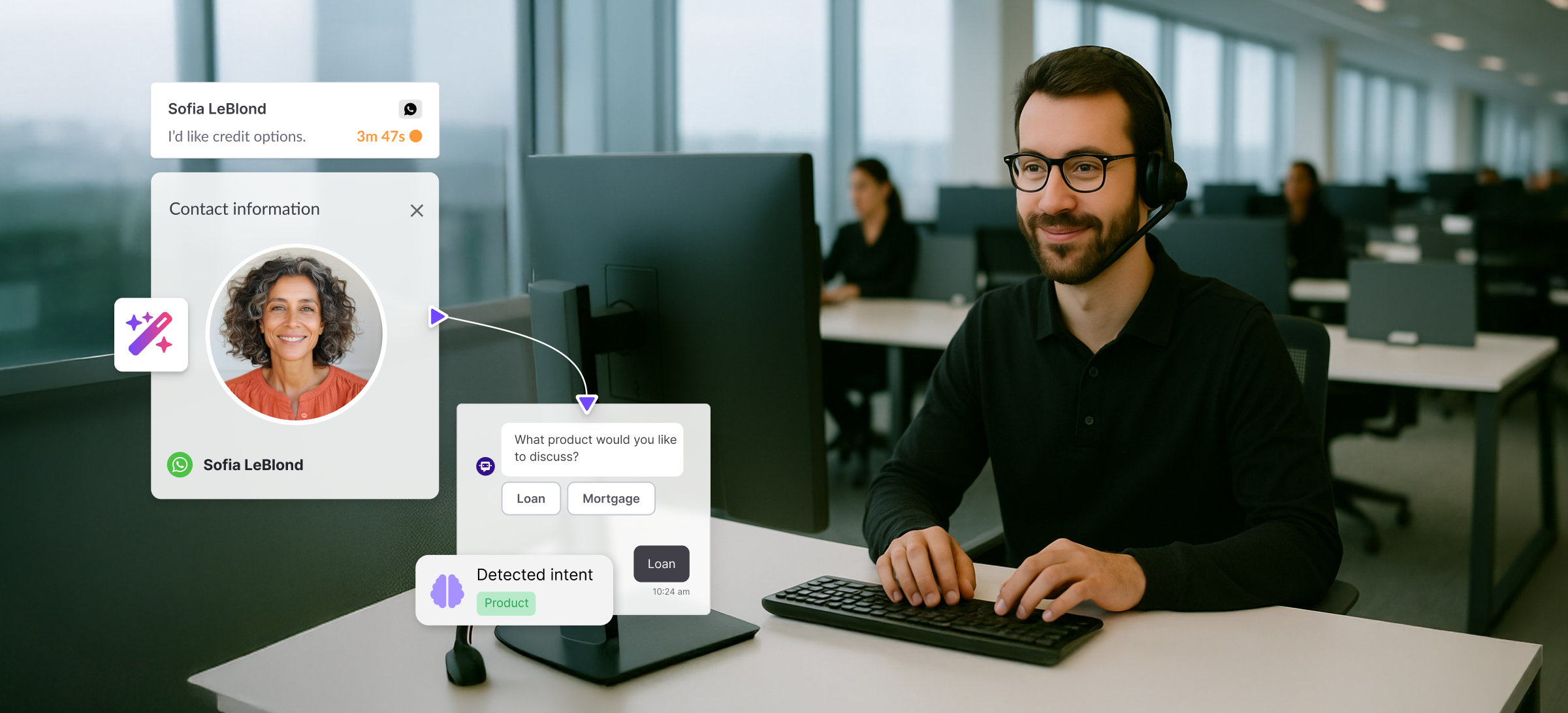

3. Empowered contact centres

The experience customers have with contact centres is closely linked to overall customer satisfaction and not always in a positive way. In 2019, Deloitte found that contact centres remain the primary channel for negative moments that matter.

The report revealed that customer satisfaction with contact centres is the lowest among all bank channels. The never-ending interactive voice response (IVR), the need to authenticate oneself and explain the problem from scratch time and again, and the long issue-resolution time were among the top reasons for dissatisfaction.

“Banks may want to enhance their focus on the human touch and position contact centres as ‘experience centres’ with a relentless focus on customer centricity. Humanising the contact centre experience will require banks to make bigger, bolder changes to the way they operate this channel,” writes Richa Wadhwani, Manager, Deloitte Center for Financial Services.

Wadhwani suggests that banks use automation to resolve simple issues and empower agents to master critical, more important problems. A great way to apply this is with phone IVR deflection to WhatsApp. By separating common queries from complex problems, teams can create more positive moments that matter. These are the first steps towards building the contact centre of the future.

4. Human connection

Another element the best banking experiences have in common is the focus on human connection. Leading banks understand that they must embrace technology to offer a human touch, and are able to strike a balance between automation and human intervention.

“The way that the best brands get a differentiated product out there is to make everything about the product feel unique—from how you articulate the value proposition to the experience you deliver from awareness through onboarding,” says Anne Mai Bertelsen, Global Banking and Payments Industry Lead within Accenture Song. “It’s not about the product, it’s about that human connection.”

5. Financial wellness assistance

Banks are becoming more proactive in helping customers manage their finances. While most banks today have budgeting apps or financial tools, banks that personalise this information can become even more relevant to their customers' daily lives and improve the banking customer experience.

Carlos Torres Vila, Chair of BBVA, says this personalised approach is a key reason that BBVA is a pioneer of digital banking experiences in Europe. “Thanks to data and technology, we can help our customers make better decisions with their money through financial health features that offer personalised and proactive advice.”

“This is the reason why BBVA is the unquestionable leader in Europe for digital experience on mobile banking for the fifth consecutive year, according to Forrester Research,” says Vila.

6. Build customer trust

According to Accenture, only 29% of consumers trusted their banking provider to look after their long-term financial well-being in 2020, compared to 43% two years before. The report states that consumer trust was declining even before COVID-19, but the pandemic made things worse.

Alan McIntyre, Senior Industry Director of Banking at Accenture, urges banks to rebuild trust by being more transparent about fees and helping customers make better decisions. This theme was identified in 2020 and continues to be a factor today.

“From the predictions we had for 2020, one of the hits was to really look at fee transparency and the role that banks have in helping their customers make better decisions. And I think what we thought at the time was that banks really needed to rebuild trust with their customers by helping them understand their cash flow, rather than indulging in the ‘gotcha!’ moments of saying ‘you went overdrawn, here's a $30 fee,’” says McIntyre.

Rebuilding trust will pay off for banks willing to invest. Accenture predicts that incumbent banks could increase their retail revenue by an average of 9% by rebuilding customer trust and introducing innovative advisory services.

7. A solid technological foundation

It’s no surprise that a solid technological foundation is necessary to support best-in-class banking experiences. Bill McNulty, Operating Partner of Capital One Ventures, explained the importance of this at Lightico’s Virtual Banking Summit.

“On the customer service side, Capital One started four or five years ago at the bottom of the stack to bring our data ecosystem together in a more organised way across lines of business. So far, we moved completely to the cloud and closed all our data centres. It’s from that foundation that we’ve been able to build the insights necessary to improve our operations and digital channels to better serve customers,” says McNulty.

Legacy systems continue to pose one of the greatest obstacles to innovation. The best banking experiences often begin with the modernisation of these systems,

8. A super-app strategy

According to Accenture, the mention of super-apps in banks’ annual reports and other public communications has increased more than six-fold between 2019 and 2021. Super apps accelerate the need for omnichannel experiences as they bundle online messaging, social media, payments, and marketplaces together in a way that makes them far more disruptive than traditional apps.

The rise of super apps in China and Eastern markets shows how powerful they can become. Banks, tech companies, and messaging platforms all play an integral role in the formation of a super-app, and they each stand to gain from becoming the next big hit.

According to Michael Abbott, Senior Managing Director–Global Banking Lead at Accenture, one thing is clear: banks will need a strategy to compete in a super-app world. “In the coming year, banks will face a critical decision: should they become a super-app, collaborate with one, or keep away from the fray?” says Abbott.

9. Good talent management processes

The digital transformation in banking requires banks to have a good handle on their human resources and talent. As new digital channels emerge, they’ll need people in place to operate and manage them.

According to Federico Berruti, Partner at McKinsey & Company, understanding their talent’s strengths helped banks meet expectations during the pandemic.

“Banks that were very successful in meeting customer expectations during Covid really understood and made the most of their employees’ talent. They were the ones that could say ‘I’m taking a thousand people and moving them into certain call centres or certain operational processes because they knew exactly who was a producer versus who was a strategic growth enabler versus a project manager. These banks had real granularity on their internal operations and workers” says Berruti.

10. A conversational approach

Finally, the best banking experiences are conversational. Most post-pandemic case studies show that people prefer to talk with banks like they talk to their friends and family members: on messaging channels.

Bank of America is a leading example of how conversational banking can make a significant impact. In Q4 of 2021, 24 million customers used Bank of America’s Erica chatbot. Erica completed 123 million interactions, which was up 247% year on year.

“Now more than ever, consumers and businesses depend on digital, and Bank of America continues to deliver efficient, safe, and reliable digital financial solutions,” said David Tyrie, Chief Digital Officer and Head of Global Marketing at Bank of America.

“Our digital capabilities allow our clients to easily manage every aspect of their financial lives across banking, investing, lending and retirement, with access to advice and guidance from our financial professionals and through our financial centres when they need it.”

The best banking experiences don’t just happen, they’re intentionally designed to meet the evolving expectations of today’s consumers. From seamless digital interactions to personalised financial guidance, top banks are setting new standards for convenience, trust, and innovation. As technology continues to reshape the industry, financial institutions that embrace change strategically, balancing automation with human connection, will be the ones that thrive.

.jpg)