Improving the banking customer experience is a top priority for 2025, and for a good reason.

A one-point increase in a CX index score can help traditional retail banks earn an additional $144 million in annual revenue.

What’s more, 89% of organisations today compete mostly or entirely based on customer experience. In other words, modern banking customers care less about interest rates, account features, or branch locations. Instead, they have come to expect convenient, seamless, and personalised banking experiences.

In this article, we look at what modern customers expect from financial institutions and what they can do to stay competitive in 2025.

What customers expect from their banking experience

Customer expectations are rising across all industries, and banking is no exception. People no longer compare their experiences between two competitor banks. Instead, they compare the ease of their experiences across all industries.

Customers now expect the same level of personalisation, speed, and convenience from their banks as they do from their streaming or shopping platforms. Companies like Netflix, Amazon, Spotify, and Uber have created a new set of customer expectations.

With tech companies setting the bar high, it’s no surprise that customers want their banking experiences to be:

- Easy

- Fast

- Simple

- Personalised

- Transparent

- Secure

These are key elements of the improved customer service clients expect, regardless of the product or service category.

How to Improve Customer Experience in Banking

So we know that improving the banking customer experience is critical, but which areas will have the most impact? To answer that question, we’ve analysed the industry’s leading research reports and customer experience surveys, and are rounding up our key takeaways. Below you’ll find the key priorities for banks as we move further into 2025.

1. Create a frictionless onboarding process

One of the top pain points for banking customers is account creation and onboarding. Research shows that European financial institutions lose almost two-thirds of applicants during onboarding.

Over 5 billion euros are lost annually due to onboarding drop-offs as 68% of bank application users abandon the process (up from 63% in 2020). Lengthy processes and too much information required were among the top reasons why people abandoned the application process.

For many banks, identifying friction in the onboarding process should be the first step to improving customer experience. Remember that onboarding does not begin at the time of ‘form-filling’. Instead, it starts by helping customers understand which products and services are most relevant to their unique needs.

The goal is to eliminate as many onboarding steps as possible while still adhering to regulatory requirements. Many banks are using new identification processes that feature biometric authentication as part of the customer identification process.

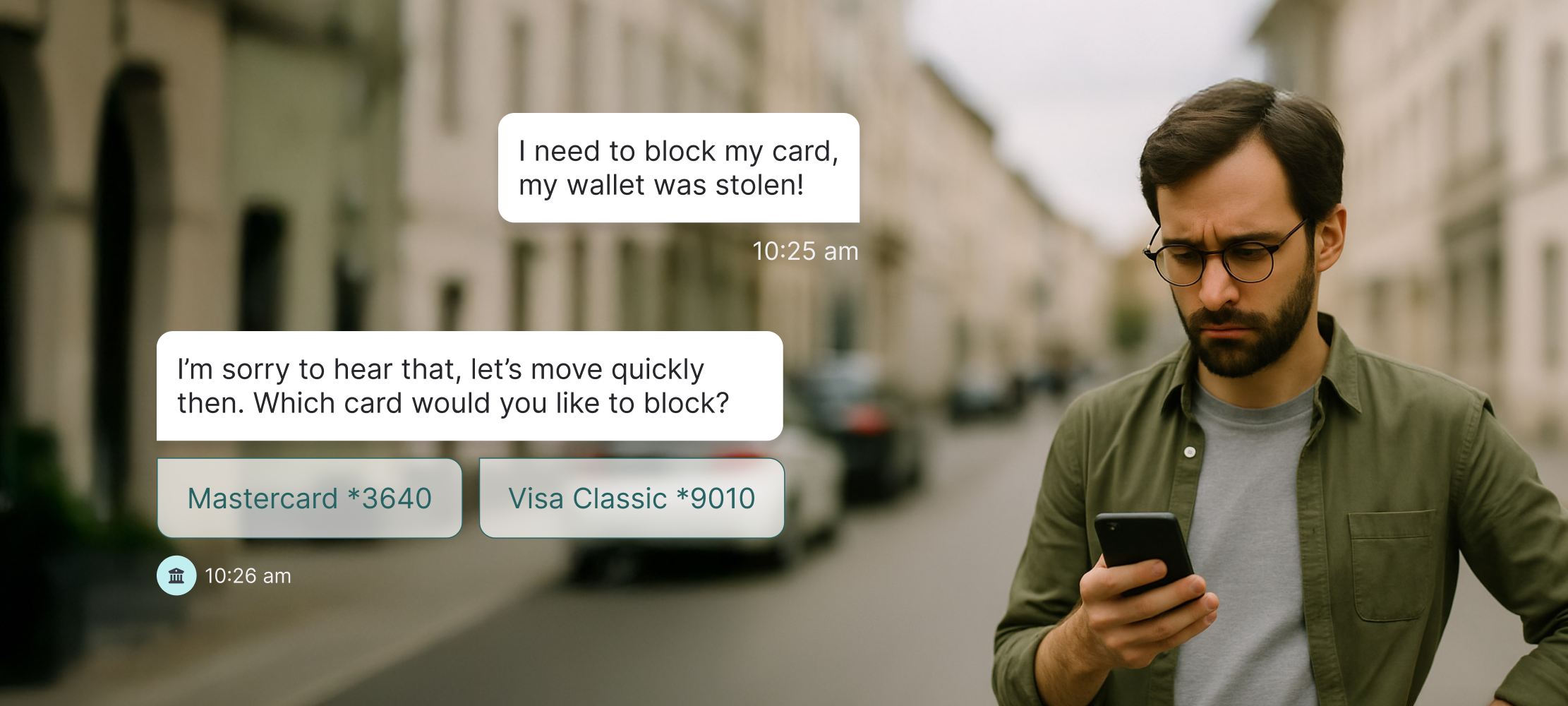

2. Implement a conversational strategy

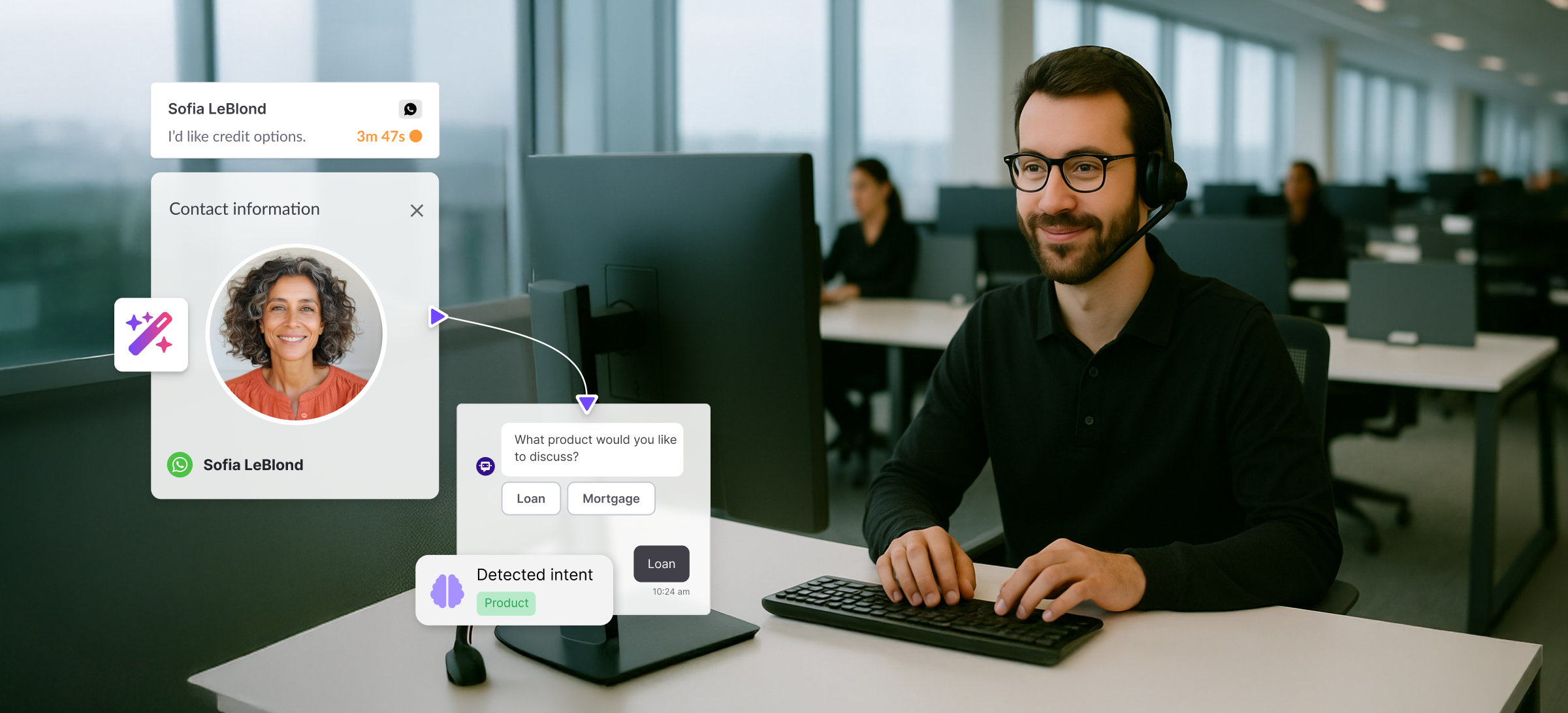

Conversational banking is about serving customers through natural conversations. It streamlines the customer journey, reducing the number of actions needed to complete a goal. For example, instead of searching through product pages, account features, and rewards, banks can make it easier for customers to compare their options. They can ask a series of automated questions to guide customers to the most suitable products. Setting up a sound conversational strategy has been key for fintech companies.

One of our banking clients faced a challenge with gathering documentation for loan applications using traditional communication channels. In traditional channels such as phone and emails, this process becomes inefficient, time-consuming, and often results in a poor customer experience.

By introducing a messaging channel (e.g., WhatsApp) our client experienced the following benefits:

- The messaging platform had a response rate of 48%, significantly higher than other methods (phone or email).

- 70% increase in user engagement when sharing necessary documents for loan applications through the messaging channel. There was a higher average number of documents submitted per client.

- The asynchronous nature of the messaging channel allowed users to interact at their convenience, improving customer satisfaction. Users felt comfortable as they valued the channel’s convenience and the personal touch it provided.

In short, conversational banking helps customers feel assured and guided. They are less likely to get overwhelmed or lost in a sea of information. This is particularly important during defining moments; like opening an account or applying for a home loan.

Find out more about how financial institutions use WhatsApp and Banking Chatbots benefits.

3. Embrace GenAI

While the adoption of GenAI in banking comes with its own set of challenges, banks can overcome them by taking proactive and strategic measures.

Despite these challenges, the potential benefits of GenAI in banking are significant, its implementation has the potential to substantially boost productivity and operating profits. It is estimated that this technology could add anywhere between $200 billion to $340 billion annually, which is equivalent to 9 to 15 percent of operating profits.

What are the top use cases for GenAI in banking?

- New product development

- Customer operations

- Marketing & Sales

- Loan origination and decisioning

- Support in risk compliance

To fully benefit from the potential of GenAI, businesses must do more than simply subscribe to a chatbot service. To capture the productivity gains that AI can bring, companies require a modern infrastructure and a well-organised system landscape that can integrate and process AI-generated instructions. This includes tools like chatGPT for banking and conversational CX platforms.

4. Make your mobile app more intuitive

Fidelity National Information Services (FIS), an organisation that works with 50 of the world’s largest banks, noted a 200% increase in new mobile banking registrations in early April 2020, and an 85% jump in mobile banking traffic.

But even though mobile banking is up, many customers are not happy with their mobile banking apps. They cite the banking apps' features as slow, clunky, and even wrong.

According to PYMNTS research, more than 1/3 of respondents were “not happy at all” with the state of their mobile banking app. 60% of respondents stated that it simply wasn’t a great experience when they tried to add or remove people from their accounts or conduct other basic activities.

As a result, banks should take a hard look at the UX of their mobile banking apps, and not be lulled into a false sense of security. Also, look at how these apps are being rated and measured, as there seems to be a disconnect between high app store ratings and low customer satisfaction scores.

5. Deflect from IVR to digital channels

A study by Vonage Research found that 63% of people believe that reaching an Interactive Voice Response (IVR) menu makes for a poor experience. More than half of people who reach an IVR menu abandon the company altogether.

That's a huge deal in the banking industry, in which the average acquisition cost of a customer is roughly $200.

While telephone-based support and automated menus have their place, banks should focus on phone IVR deflection to Whatsapp or other digital channels with higher net promoter scores. Not only does this increase customer satisfaction, but it also frees up agents for higher-value conversations.

Key benefits

- Significant budget savings from a high reduction of calls with live agents

- Satisfied customers due to no waiting time

- Available in WhatsApp (top results) and Webchat

Proven results

- 20-40% call deflection rate

- 40-80% completion rate with automation

- 90% customer satisfaction

6. Provide customers with self-service opportunities

Self-service is transforming customer service and organisations are betting on it to improve CX. The shift towards self-service is driven by consumer demand for instant, accessible solutions and the technological advancements that make these interactions possible.

Banking customers want to be in control. And they have become familiar and comfortable with the technology that allows them to be in control. They’d rather take a photo of a check than wait in line to deposit it. They’d rather go to an ATM than visit their local bank.

The same applies to customer service interactions. Banks should invest in tools that empower customers to get the information they need when they need it. Through banking chatbots, resource portals, and conversational interfaces, banks still have many opportunities to improve the self-service banking customer experience.

7. Tie products to life events at the right time

Relevance is a key part of the banking customer experience. Most banks aim to address customers’ unique needs when important events occur in their lives. Doing so helps them drive more sales, deepen trust, and build customer loyalty.

Some of these critical moments include buying a house, the first paycheck, purchasing a vehicle, getting married, or handling a parent’s affairs after their death. In the past, they have been hard to predict, but new technology makes it easier to estimate when these moments will occur.

Banks can use anonymised data to detect fluctuations in income or newly seen trends in spending. They can then enrich customer profiles with insights and detect potential upcoming needs.

8. Provide customers with financial literacy skills

Part of a bank’s customer service strategy can include helping consumers navigate their choices. Whether they are small or large, banks can aid in the decisions that affect customers’ financial well-being.

When banks take on the role of a mentor, they can deepen customer relationships and increase profitability. Not to mention, they can help customers increase their wealth over time–which is a win-win for both the bank and the customer.

9. Solicit and implement customer feedback

Last but not least, ask customers about ways to improve their experience. Many banks use simple surveys to gauge customer satisfaction: this helps increase the number of responses.

But, it’s important to ask open-ended questions as well. Open-ended questions help banks see things from the customer’s perspective–instead of canned responses. While this feedback is harder to gain and implement, it is an essential part of improving CX in financial services.

Next steps

You can lead the way in delivering exceptional customer experiences by embracing the future of banking. From simplifying onboarding processes to employing Generative AI for personalised service, each step you take can significantly impact customer satisfaction and loyalty. Remember, the journey toward excellence in CX is ongoing and requires constant adaptation and innovation.

Want to learn more about the future of banking? Read our report: The State of Messaging in Banking.

.jpg)