The WhatsApp Business API is a powerful tool for banks. With it, they can scale customer communication on WhatsApp and bring new products and services to market.

In this article, we’ll discuss everything you need to know about WhatsApp banking. Learn about how to access the API, why it matters now, and examples of leading banks using WhatsApp.

What is the WhatsApp Business API?

The WhatsApp Business API connects banking software to WhatsApp’s services. Essentially, it’s an interface between a bank’s internal tools and their customers on WhatsApp.

The WhatsApp Business API gives banks the flexibility they need to use WhatsApp at scale. It connects customers, vendors, and processes in a way that makes conversations more contextual and meaningful.

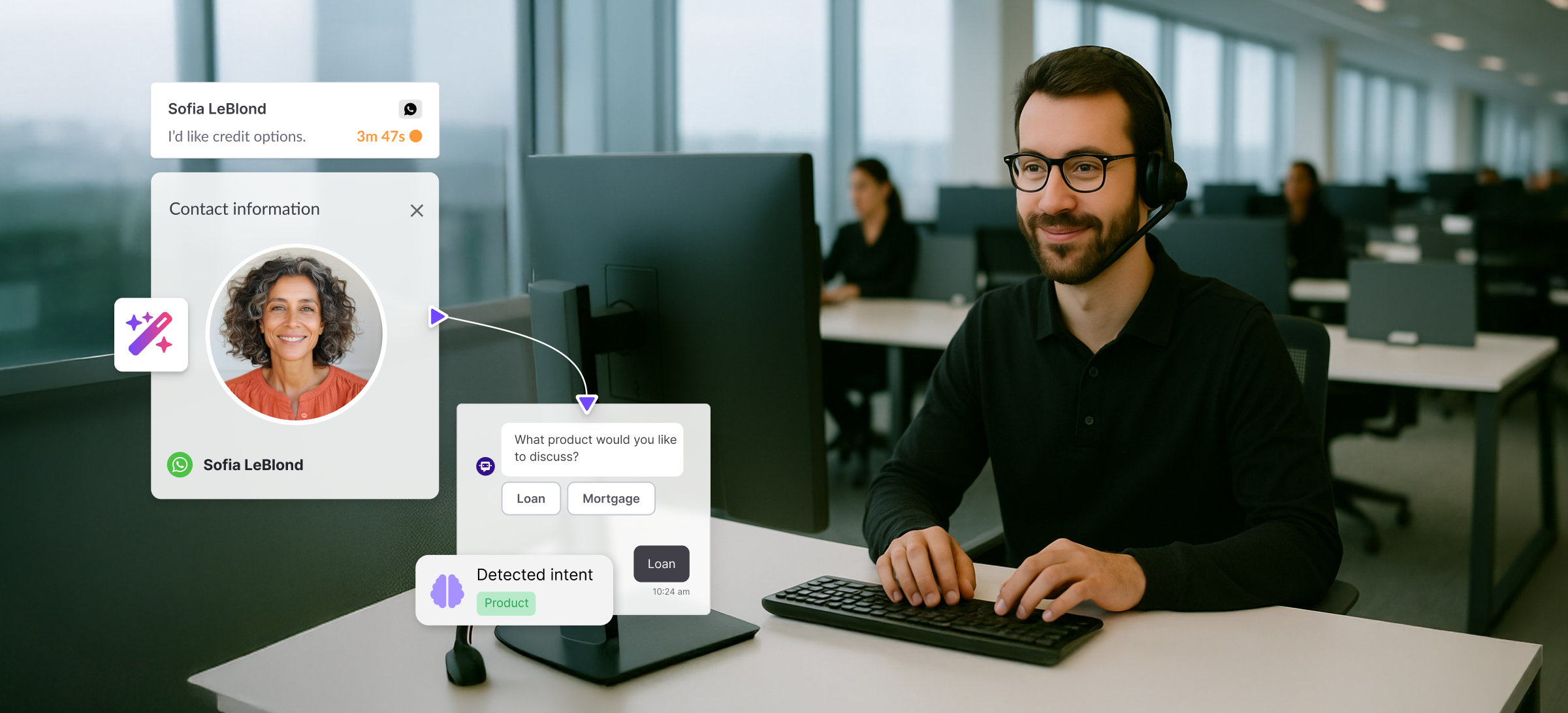

With the WhatsApp Business API, customer service teams can collaborate from a shared inbox, automate frequently asked questions, and leverage customer information. As a result, banks can achieve more through 1:1 conversations.

How does the WhatsApp Business API work for banking?

The WhatsApp Business API is a programming language interface. Using the API, banks can connect thousands of agents and bots to interact with customers programmatically and manually.

In most cases, banks work with WhatsApp’s third-party business solution providers (BSPs) to access the WhatsApp Business API. These third-party providers host a set of WhatsApp tools and protocols on their servers so that banks don’t have to.

Using an official third-party solution provider helps bypass operational challenges and speed up the development process. In addition, these solution providers have the expertise banks need to use WhatsApp securely and effectively.

Note: Hubtype is an official WhatsApp Business Solution Provider. WhatsApp trusts us to help banks create seamless customer experiences on its platform.

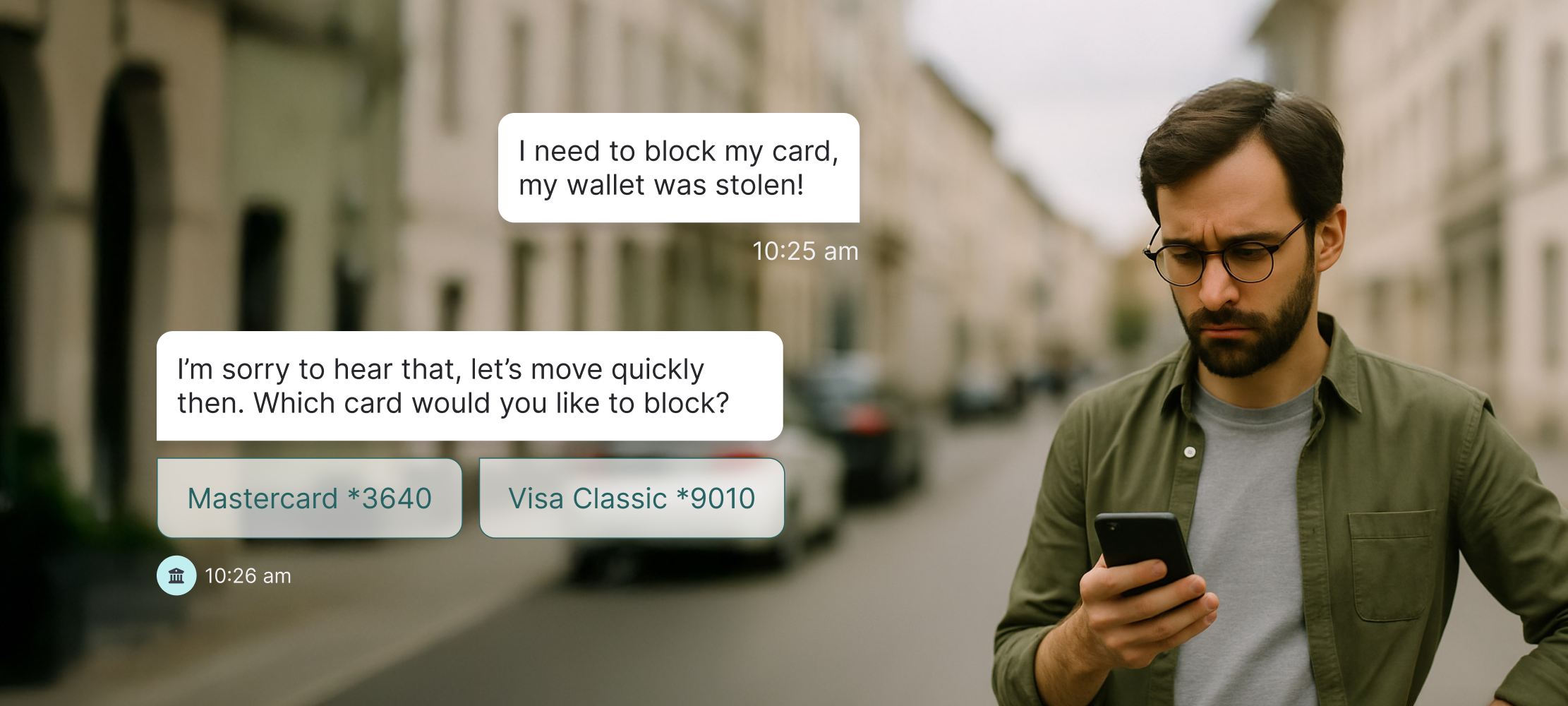

Below is an example of the type of banking experiences we build on WhatsApp:

Benefits of WhatsApp Banking

Security

All WhatsApp messages and calls are secured with end-to-end encryption. Only the bank and the customer can read messages or listen to calls. Nobody in between, not even WhatsApp, can read business communication.

In addition, banks can integrate security protocols directly into conversations. Before carrying out payments, transfers, or other functions, they can require customers to authenticate themselves.

Authentication can be done with a password, phone token, biometric password, or a combination of all three. This is particularly important as regulatory requirements like Strong Customer Authentication (SCA) take hold globally.

Customer Experience

Customer expectations for the retail banking experience are rising. People expect the same seamless, convenient service from banks as they get from tech companies like Amazon, Netflix, and Uber.

As such, customer experience is now a key driver of growth. Retail banks that regularly practice customer experience optimization grow more than three times faster than competitors that don’t.

WhatsApp is proven to help banks meet these growing expectations. Through automation, better data, and integrations, banks can offer the immediate, personalized service their customers want.

Efficiency

WhatsApp banking makes customer support teams more efficient. They can automate frequently asked questions and resolve queries faster than with traditional channels.

Conversational banking resolves most queries in less than 2 minutes. It also decreases calls to contact centers by 50% thereby freeing up human resources.

Faster Innovation

The WhatsApp Business API makes it easier for financial institutions to innovate. Instead of building new products and services from scratch, they can work with a network of third-party provides.

This means that instead of going head-to-head with fintech companies, banks can partner with them to offer modern digital solutions.

Increased Revenue

According to Accenture, conversational banking can accelerate revenue growth by 25 percent and reduce costs by up to 30 percent. That's a considerable upside for banks amidst intense competition.

Why WhatsApp Banking matters now

New regulations make the industry more competitive

Regulations like Open Banking and the Payment Services Directive (PSD2) make the banking industry more competitive. These regulations facilitate the use of open APIs (like the WhatsApp Business API).

As a result, the industry is undergoing a digital transformation and new players are entering the market. While these regulations are beneficial for banks willing to embrace change, they will also be the downfall for incumbents that resist.

Conversational banking is mainstream

Conversational banking is no longer just hype. Banks are starting to understand the benefits that come with opening a channel like WhatsApp.

According to Allied Market Research, the global AI in banking market generated $3.88 billion in 2020, and is anticipated to reach $64.03 billion by 2030, manifesting a CAGR of 32.6% from 2021 to 2030.

Conversational banking on channels like WhatsApp is a key driver of this trend. Later in this article, we’ll discuss which global banks are using WhatsApp to improve experiences and attract new customers.

WhatsApp is the leading platform for conversational banking

WhatsApp is a natural home for conversational banking experiences. It’s the most popular messaging app in the world, with over 2 billion monthly average users.

WhatsApp is also a leading platform for building rich media experiences. A major benefit of using WhatsApp is that you can use buttons, quick replies, product carousels, voice memos, photos, maps, and other types of rich content.

Using this rich content makes conversations more engaging. It eliminates the need for customers to type everything out, thus reducing the time to resolution.

WhatsApp Banking use cases

Onboard customers

The process of onboarding commercial banking clients can be a long and expensive one. According to Deloitte, the process can take as long as 16 weeks to complete, often hampering the customer experience. The same report finds that banks may end up investing as much as $20,000-$30,000 to onboard a new client.

Deloitte predicts banks can save hundreds of millions of dollars by automating the onboarding process. This is an ideal use case for WhatsApp that should be explored by banks.

Automate FAQs

Help customers check bank balances, find local ATMs, check interest rates, credit limits, and more.

Provide account services

Automate questions about bonus points, recurring payments, and transfer limits. Help customers securely update account information and reset passwords with ease.

Send reminders

Remind customers when automatic payments are scheduled to take place, or when bills are coming due.

Automate urgent responses

If a customer has a lost or stolen credit card, automatically help them place the card on hold or cancel it.

Banks around the world are using WhatsApp

Bankia (Spain)

Bankia, the fourth largest bank in Spain, uses WhatsApp to help customers apply for mortgage loan applications. Customers are guided through the application process conversationally, which makes it simple and easy for customers.

The bank reports improved net promoter scores, handling times, higher engagement, and an increase in qualified leads. The goal is to gradually incorporate other products and services, so that in the future any issue can be addressed through WhatsApp.

Banco Bradesco (Brazil)

Banks in Brazil are trading in their own branded apps for the apps and platforms that their customers use on a daily basis.

Clients of Brazilian bank Banco Bradesco used WhatsApp to consult the bank’s artificial intelligence-powered chatbot 88.5 million times in 2019, a 16-fold increase in interactions compared to the previous year.

As a result, Bradesco reported strong growth in digital customers in 2019. It registered 15.8 million active digital clients in December–a 12% increase from the previous year.

Emirates NBD (UAE)

In 2019, Emirates NBD launched WhatsApp Banking solutions in an effort to customize mobile banking services to its customers, which was reportedly a first in the region.

The WhatsApp banking service allows customers to interact with the bank through the chat for functions such as checking account balances, the last five transactions of account or credit cards, or the last credit card mini statement, temporarily blocking or unblocking cards, new checkbook requests, and checking foreign exchange rates.

Deutsche Bank (China)

In 2020, Deutsche Bank announced the onboarding of a new digital employee, named Blue Bot ‘Yi’, within its Corporate Bank division in China.

This is the Corporate Bank’s first digital employee with a client-facing role. It will be responsible for handling real-time customized financial reports and processing client inquiries. It has already been trialed successfully with two of the bank's corporate customers in China.

Goldman Sachs (United States)

Goldman Sachs recognizes that digital banking has, by necessity, taken off amid the coronavirus pandemic. The bank rolled out AI-enabled money management tools for Marcus, its digital-only bank.

Marcus launched in 2016 and is central to Goldman's consumer banking push. An AI assistant would join other planned offerings, including a checking account.

Standard Bank Group (South Africa)

In 2020, Standard Bank Group in South Africa opened up service options on WhatsApp in response to COVID-19 related pressure.

“Our customers’ financial wellbeing remains one of our main concerns. We know that South Africans are isolated but still need information. It was important for us to develop this tool so that we could provide our customers with the banking-related information that they need instantly and on a platform that they understand, and communicate on every day,” says Deepesh Thomas, Head of Wealth Digital at Standard Bank.

Getting started with WhatsApp Banking

To get started with WhatsApp Banking, request access to the WhatsApp Business API. You can request access through any authorized WhatsApp Business Solution Provider (BSP), like us.

Hubtype has helped some of the world’s leading banks define their conversational banking strategies. We understand the unique challenges and opportunities that the banking industry faces.

Book a demo, or learn more about our WhatsApp banking solutions.

.jpg)