For those running an insurance business at an enterprise level, you know how important it is to stay on top of policy renewals.

But let's face it, sending emails and making phone calls just doesn't cut it anymore. Not in today’s world with all the digital and instant communication anyway. That’s why in this blog post, we’ll be talking about how conversation, chat, and AI can boost your policy renewals.

First things first, let's talk about overcoming challenges in the Insurance Industry when it comes to adopting new technologies.

So, here's how conversation, chat, and AI can address these challenges:

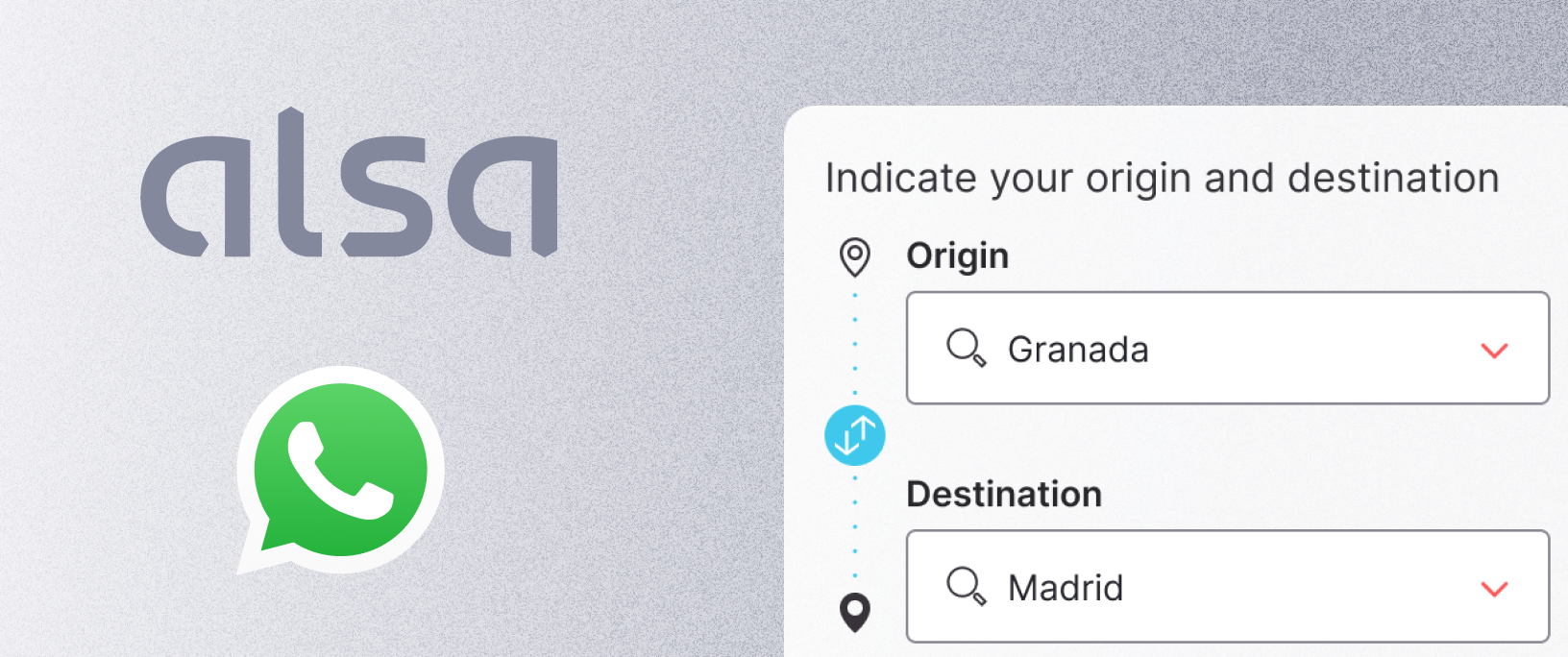

- Adapting to Digital Channels: Insurers need to meet customers where they are, which increasingly means digital channels, such as Messenger and WhatsApp.

- Innovation in a Traditional Industry: Finding innovative solutions can be challenging in an industry deeply rooted in tradition. However, embracing Conversational AI technologies is essential to stay competitive and relevant.

- Improving Customer Lifetime Value (LTV): AI-powered personalization can increase LTV by offering tailored services and recommendations that keep customers engaged.

- GDPR Compliance and Security: Insurance companies must adhere to strict data protection regulations. Partnering with providers like Hubtype ensures GDPR compliance and data security.

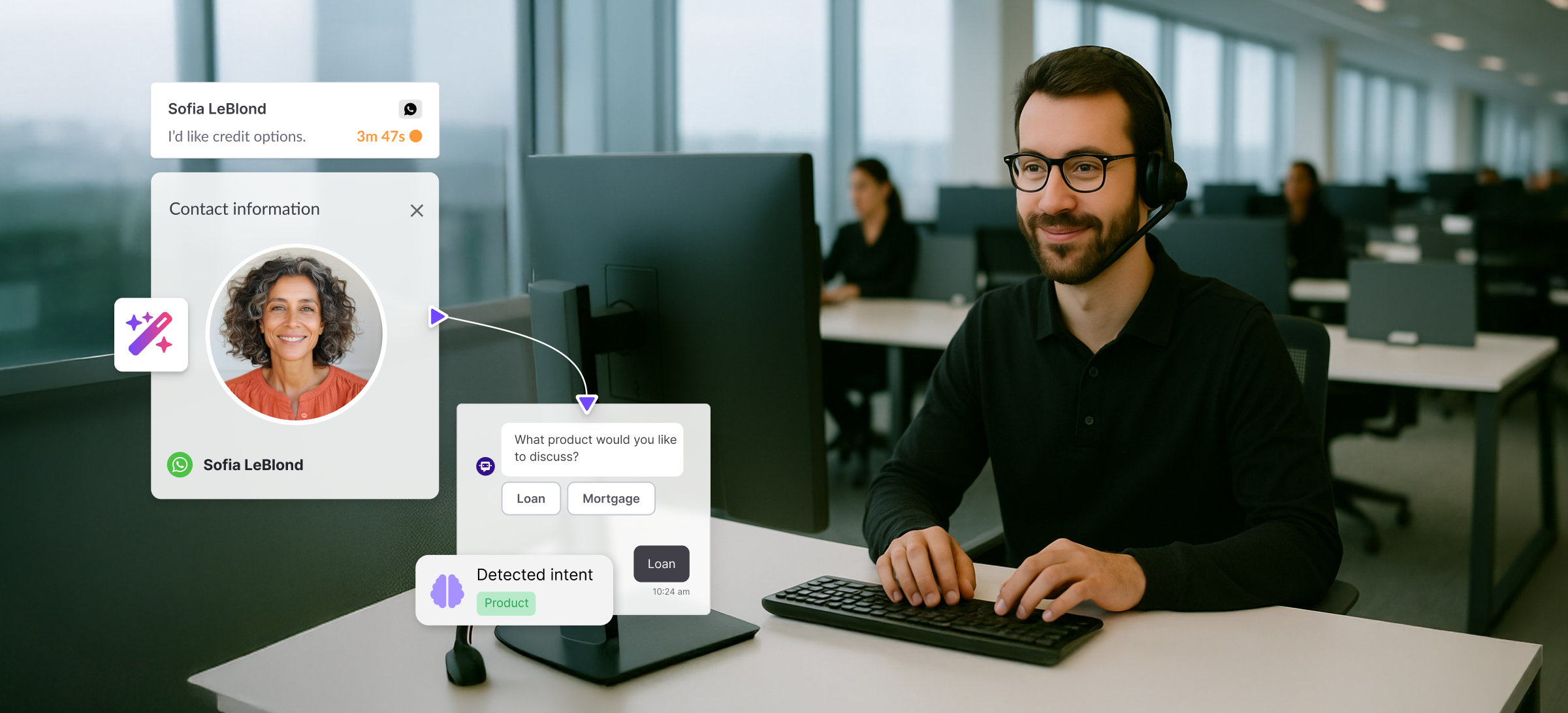

- Meeting SLAs: Traditional phone-based customer service often struggles to meet SLAs. Messaging apps and chatbots offer faster response times, improving customer satisfaction.

- Integration with Existing Systems: Integration challenges can be addressed through flexible chat and AI solutions that work with existing backend and CRM systems.

Now, what strategies can you implement to boost policy renewals with conversation, chat, and AI?

In any industry, it is known that keeping customers loyal means being proactive and staying ahead of the curve with the latest tech.

- Have you noticed how messaging apps are always offering us personalized services? Messaging apps are great at providing a scalable platform to interact with your policyholders.

- With conversational platforms and messaging apps, you can enhance the perceived value of your insurance products by providing quick and efficient services.

- Automation makes it so much easier to process claims, plus it will save your agents a lot of time, which will save the company a lot of money. Automation not only shortens claims cycles but also prevents fraudulent claims through advanced algorithms.

- Streamlining the claims process with messaging apps and AI makes it easier for policyholders to navigate, reducing friction and increasing the likelihood of policy renewals.

- Cross-Selling and Up-Selling with messaging apps. You can promote additional insurance products and suggest comprehensive coverage options to your policyholders that they might not have known about before.

By implementing these strategies, you can transform policy renewals into opportunities for building stronger customer relationships.

Next, we can talk about really leveraging conversation, chat, and AI for Policy Renewals.

For that, here are some use cases:

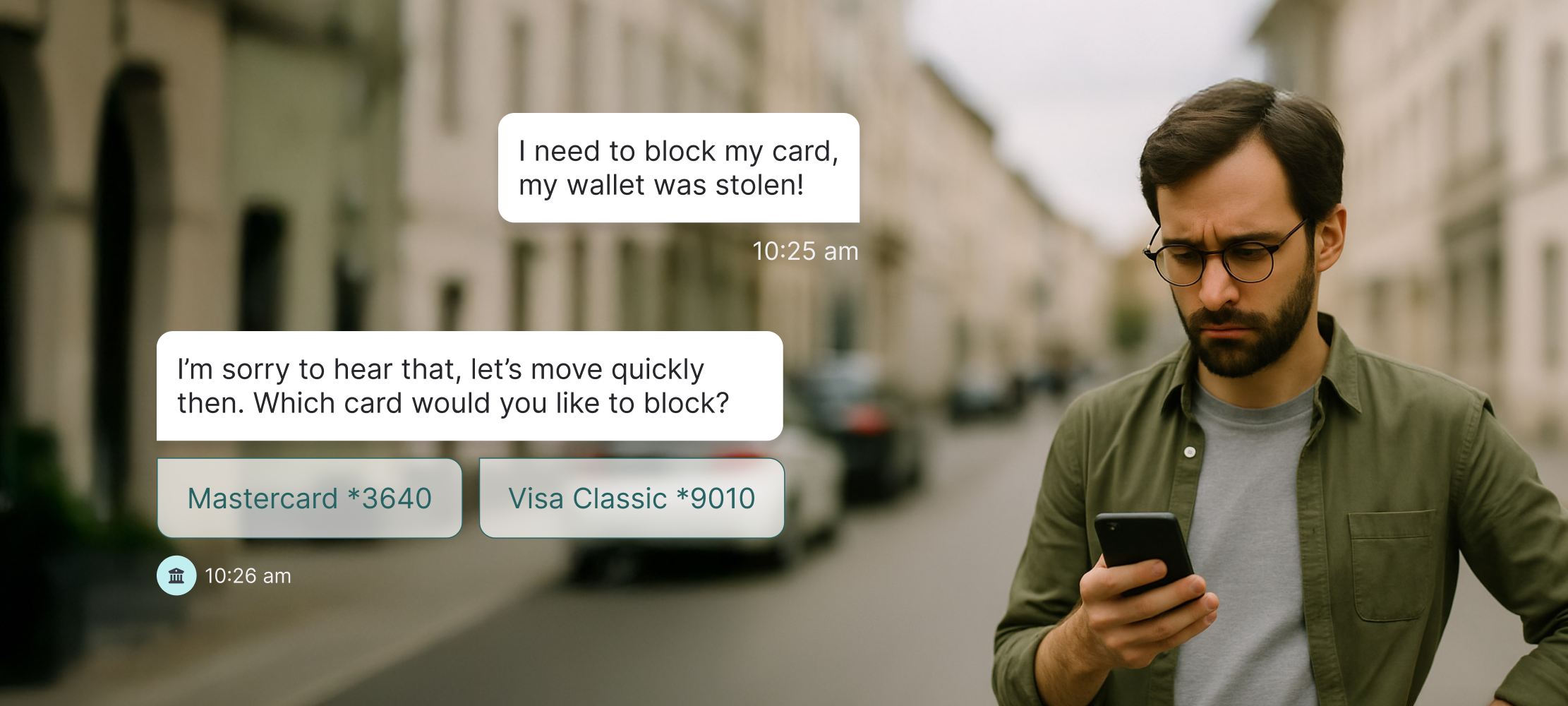

- Chatbots simplify the renewal process, allowing policyholders to renew and pay within a single conversation, creating a seamless experience.

- Offering omnichannel support for renewal, such as apps and websites, provides flexibility and convenience for customers.

- Regular communication with policyholders builds trust and ensures they stay informed about their policies.

- Providing hassle-free self-service options empowers customers to renew their policies independently.

- Messaging apps can be used for promoting additional insurance products, increasing the value of each policyholder.

If insurance companies start implementing these use cases, they can make renewing policies a lot more enjoyable for customers and get them more involved in the process. Don’t you think?

We want to help you boost your policy renewals by leveraging conversation, chat, and AI.

How?

- By being an official WhatsApp Business Solution Provider, you can trust us with our expertise in navigating WhatsApp's policies and tools for meaningful conversations.

- You can get a higher engagement with our rich visual elements like webviews, buttons, and media to create immersive experiences that go beyond text-only chatbots. That’s what we do best!

- Our customization is unrivaled, allowing integration with various systems and APIs to meet your unique requirements and future scalability needs.

- By providing you with expert support from project managers to NLP engineers, ensuring the successful implementation of conversational solutions.

- GDPR compliance, saving time, preventing data breaches, and avoiding penalties.

- You will reduce costs and shift customer channels to digital with our strategy of a conversational approach for the future.

If you’re not yet convinced, have you heard about this awesome success story?

Roadside Assistance Automation: A prime example of Hubtype's impact in the automation of roadside assistance for a leading Spanish insurance company.

- Challenges: The traditional assistance process required customers to provide detailed information over the phone, adding frustration to an already stressful situation.

- Project Objectives: Hubtype aimed to reduce case management time, increase customer satisfaction, create a smoother experience, and reduce incoming calls.

- Solution: Hubtype leveraged WhatsApp's capabilities, allowing customers to share photos and locations instantly, automating incident reports, and connecting customers with live agents when necessary.

The result was a significant reduction in calls, increased customer satisfaction, and a streamlined experience for policyholders.

Embracing conversational AI is the path to boosting policy renewals. This technology not only addresses industry challenges but also provides innovative solutions that engage policyholders while also improving customer lifetime value.

.jpg)